There's not much you can do without an income. In monetary terms, your ability to earn an income is your biggest asset by far - which is why income protection is so important.

When you’re protecting your biggest asset, there are 3 things you need to understand so you know what you’re covered for, and what that means at claim time:

How much you’re covered for – amount insured

How long you need to wait for your claim to be paid – the waiting period

How long your claim will be paid for – the benefit period

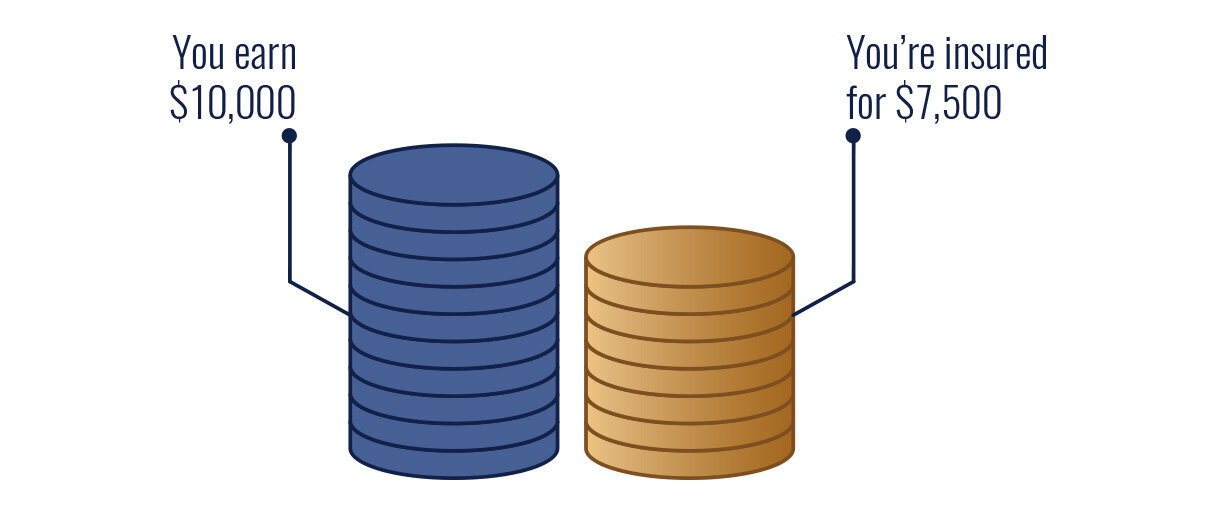

1. Sum insured

When you apply for income protection, you can generally choose to insure up to 70% of your before-tax income (which sometimes includes super contributions). The higher your amount insured, the higher your premium will be. So you need to think about how much money you’ll really need to keep up with your everyday expenses (like your rent/mortgage, bills, school fees etc.). Just because you can cover 70% of your income doesn’t mean you have to.

For example, you might earn $10,000 per month but decide you only need $5,000 per month to keep up with your living costs. That may significantly reduce the cost of your cover (i.e. your premium).

2. Waiting period

The waiting period is the number of days before you become eligible to claim, starting from the date the doctor confirms you are disabled. The most common chosen waiting period options are 30 days, 60 days and 90 days.

Income protection payments are usually made monthly in arrears. So if you had a 30-day waiting period, your first payment would be made 60 days after you first became disabled.

The waiting period affects the premium. Naturally, a policy with a 30-day waiting period is more expensive than the same policy with a 90-day waiting period, because you’re eligible to claim sooner.

For example, if you’re off work for 80 days and have a 30-day waiting period, you could potentially be paid your amount insured for 50 days. But if you have a 90-day waiting period, you may not be eligible to receive anything.

When choosing your waiting period, you should think about how soon you’re likely to need financial support if your income stops:

If you have access to sick leave or annual leave, or a high level of savings, you may be able to take a longer waiting period and reduce your premium.

If you’re a casual employee or business owner, or you have a low level of savings, you may want a shorter waiting period, bearing in mind your premium will be higher

3. Benefit Period

The benefit period is the maximum amount of time you can receive income protection payments for any claim while you are disabled. It can be based on time (e.g. 6 months, 2 years etc.) or age (e.g. to age 65, 70 etc.) and your choice can make a difference to the total amount you receive.

Say you’re aged 40 and you become permanently totally disabled, meaning you’ll never be able to return to work. If you had a 2-year benefit period, your benefit payments would stop when you’re aged 42. But if your benefit period was to age 65, you would continue to receive benefit payments for an additional 23 years.

Choosing a longer benefit period increases your premium because the potential payout is higher. However, be aware the benefit period is the maximum amount of time you can receive payments. If you’re able to return to work sooner than that, or you reach age 65, your payments will stop.

Also, if your policy offers ‘partial disability benefits’, you may be able to return to work part-time and receive reduced payments until you are able to return back to your pre-claims earnings. This can be a great benefit to have as it means you're supported if you're restricted in your capabilities, or you want to try a new occupation.

Oh, and one more thing…

One great feature of income protection is that premiums are generally tax-deductible, which can make it significantly more cost-effective to get the cover you need.

You may also be able to hold an income protection policy inside super, meaning you can use tax-effective super contributions to pay your premiums, however, within a superannuation environment policy feature are generally more restricted..