Risk protection and tax effective investment advice for medical professionals.

NOR specialises in providing full-service financial advice to doctors, between 30 and 50 years of age, and their families. In alignment with our clients’ needs, we are highly skilled in complex life insurance and income protection strategy, considering both existing policies and new offerings on market. We also help our clients develop the foundations of tax effective structures for long term investment and wealth accumulation with no ongoing advice fees required. The team at NOR Financial have over 40 years experience helping our clients build and protect their wealth and lifestyle and we are very proud to be able to share this depth of knowledge with people all across Australia and beyond.

SUPERANNUATION

High returns and low fees..simple right? We wish Superannuation were that simple too but with constantly changing rules and market conditions this area is now more complex than ever. Australians hold over 3.4 Trillion dollars in their combined accounts & there are a myriad of options available to invest in. We can help you find the option that is right for you. Learn more >

Medical Practitioners

We provide a highly focused service to New Fellows and Doctors in training and their families. We also offer financial workshops to hospitals, practices and NFPs across Australia. We have a key offering to assist medical professionals who have immigrated from overseas in getting access to a diverse range of specialists that also know their needs well. Learn more >

INSURANCE

We offer highly specialised insurance advice for doctors. Our commission free structure is designed to reduce costs and conflicts of interest. Our in depth knowledge of insurance contracts and health conditions helps to ensure that your policy is set up correctly so, when you need it to, it pays the right money to the right person. Plus, when the time comes to make amendments or even a claim, we will be right there with you making it easier to get what you are entitled to. Learn more >

INVESTMENT

Are you saving to buy a house, want to build a robust long term investment portfolio or do you want to start saving for your child's education. We can help. Learn more >

ESTATE & SUCCESSION PLANNING

Wills and Powers of Attorney are not just about who gets what. Making sure you have a solid plan in place can save you or your family hundreds of thousands in tax too. Together with a panel of experts, we can help you to create a plan for the future that clearly illustrates your wishes and wont leave you wondering "what if". Learn more >

NETWORK

We can connect you with our extensive network of trusted professionals who can help you to solve problems that we don't specialise in. Learn more >

Our Process & Pricing

We always start with an initial discovery meeting to see how we may be of service to you. At this meeting we will agree on a fee going forward. If at this time we do not believe we can improve on your financial situation, we will tell you why and provide some general advice on how you might proceed. This initial meeting is always free of charge.

During the initial strategy session we will outline each step of our process and the estimated costs associated with first developing a plan, implementing that plan and, if required, a plan to keep things on track. NOR Financial is a primarily a fee for service business. We estimate a fee based on our hourly rate and agree on this before commencing work. We do not charge percentage based fees or any commissions on funds under management. For our expert insurance advice we will offer the choice of paying full premiums and us receiving an upfront and ongoing commission or paying a once off fee and receiving “wholesale” price that may work better for you long term. Complete transparency is a cornerstone of all our processes and pricing.

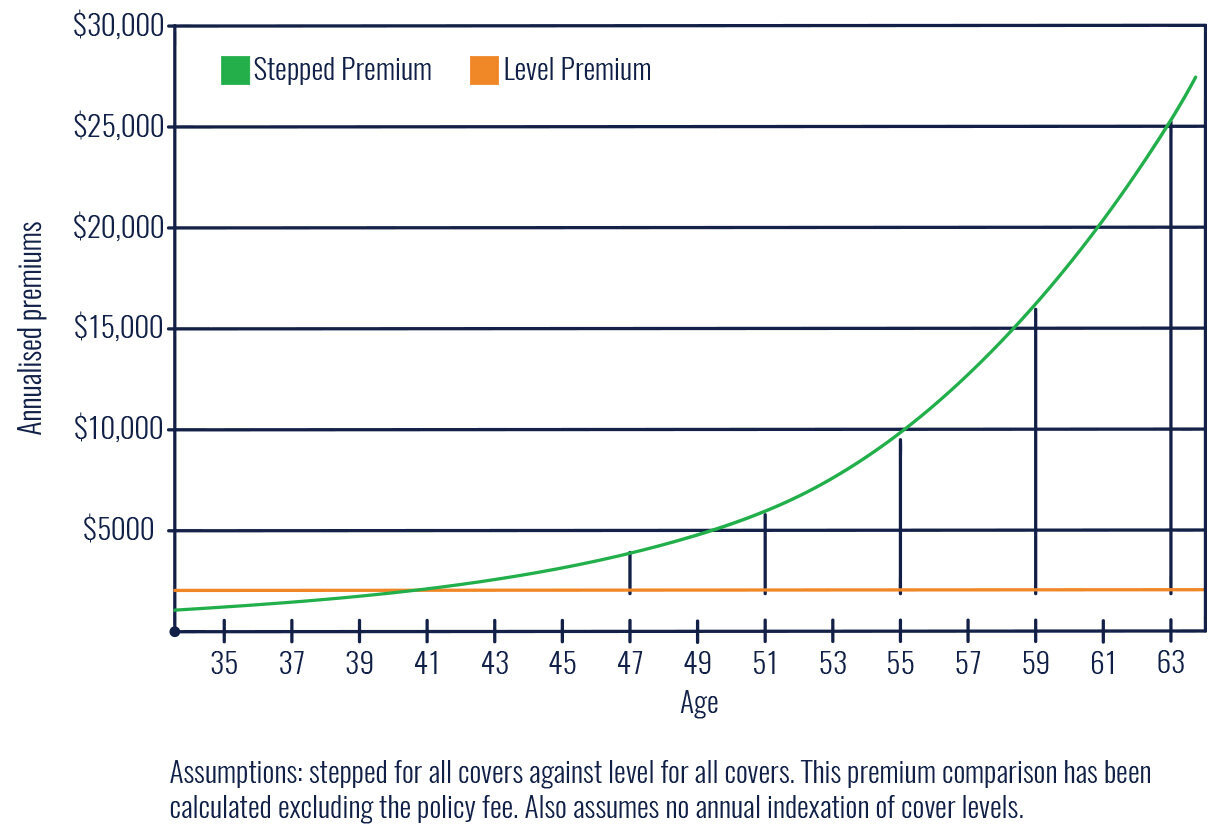

Understanding Premiums

Ever wondered what the difference between Stepped and Level Premiums is? Gain a deeper understanding about Insurance Premiums here.

Ready to Get Started?

Schedule your Initial Strategy Session and start the process towards growing your wealth today.